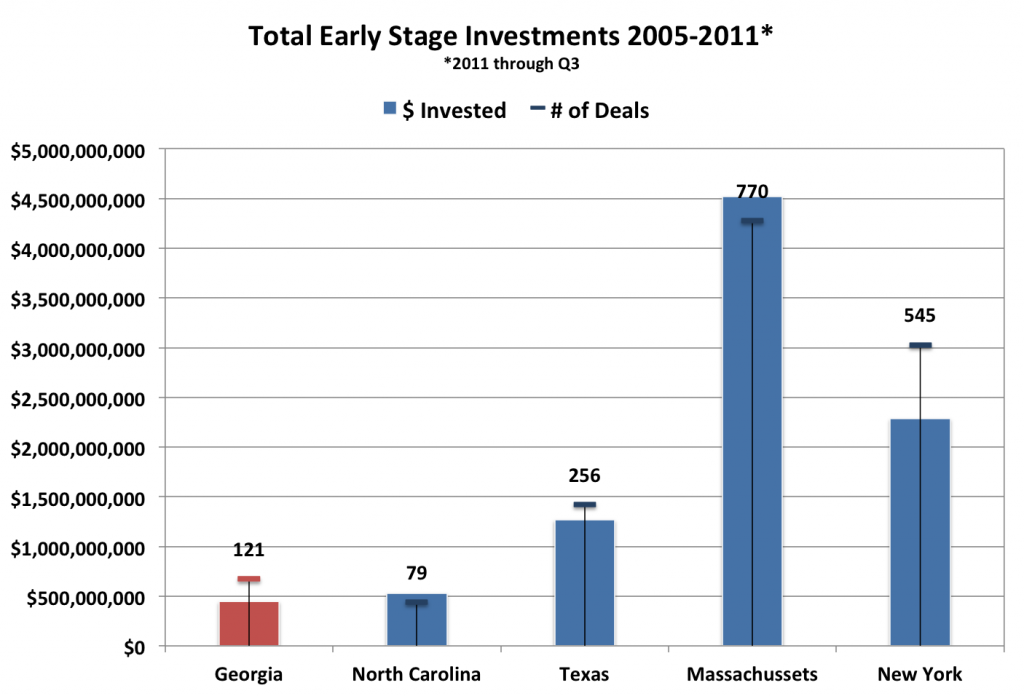

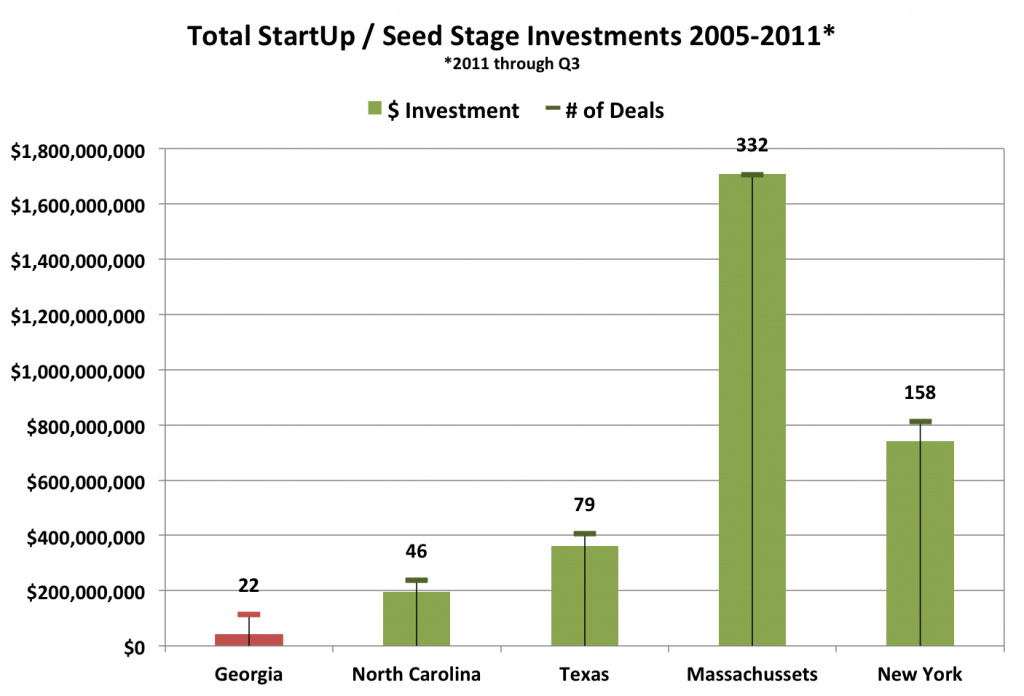

In last week’s post I took a look at data from the PWC MoneyTree Report to answer the question “does Georgia have a venture funding shortage?”. The data supported what I keep hearing from Atlanta entrepreneurs – we have a venture funding shortage, especially seed funding. This is to difficult to digest while reading stories that other areas are experiencing a ‘bubble’ in early stage funding.

Adding to the shortage is the fact that two sources of local seed funding have recently stopped making new investments. Imlay Investments, the most active seed stage fund in Georgia in the last decade, made their last new investment last year and are now focused on their 37 active portfolio companies. The Georgia legislature stopped funding the ATDC Seed Fund several years ago and “reallocated” $5 million in previously allocated funds, essentially halting new investments.

Since writing the Does Georgia Have a Venture Funding Shortage post, the Atlanta Business Chronicle published an article stating the General Assembly is expected to take up a proposal this winter to establish the Georgia Venture Capital Program establishing a $180 million fund that would follow a fund-of-funds model that has been successful in other states like North Carolina and Texas.

I hope this happens. It seems to have strong support and the right mix of legislators and leaders in the technology community supporting it. I also hope a meaningful portion of that $180 million is directed to a privately managed seed fund (or funds) to help more seed stage companies succeed. It’s the first step in any plan.

In order to accomplish one of the goals mentioned in the article of “serving as a financial magnet” to attract out of state funds to have a presence and invest in Georgia, we’ll need to increase the deal flow of quality companies. To have more quality early stage, expansion stage, and later stage companies for VCs and private equity firms to invest in, we first have to address the ‘top of the funnel’ by starting with supporting more (ambitious) seed stage companies.

What else can we (Georgia, technology community, ATDC) do to increase access to funding and grow more companies pursuing ‘big ideas’?