Earlier, I wrote a blog post about ‘pillar companies’ (read it here).

Pillar companies are the trees in the startup rainforest ecosystem – large, local, (mostly) publicly traded companies. They are big successes that produce lots of talent, wealth, and companies willing to bet on other startups’ products. Talent that moves on to new ventures and builds a mentor network. Wealth that fuels a healthy angel network and produces LPs for venture funds.

In the post I mentioned that recently Atlanta entrepreneurs often cash out before scaling. I used the qualifier ‘recently’ because although Atlanta has clearly had it’s share of pillar companies, most of the examples were a decade or more ago.

So that got me thinking – what changed? Conversations with other entrepreneurs and investors brought up a variety of theories, but they all revolved around a single factor – liquidity.

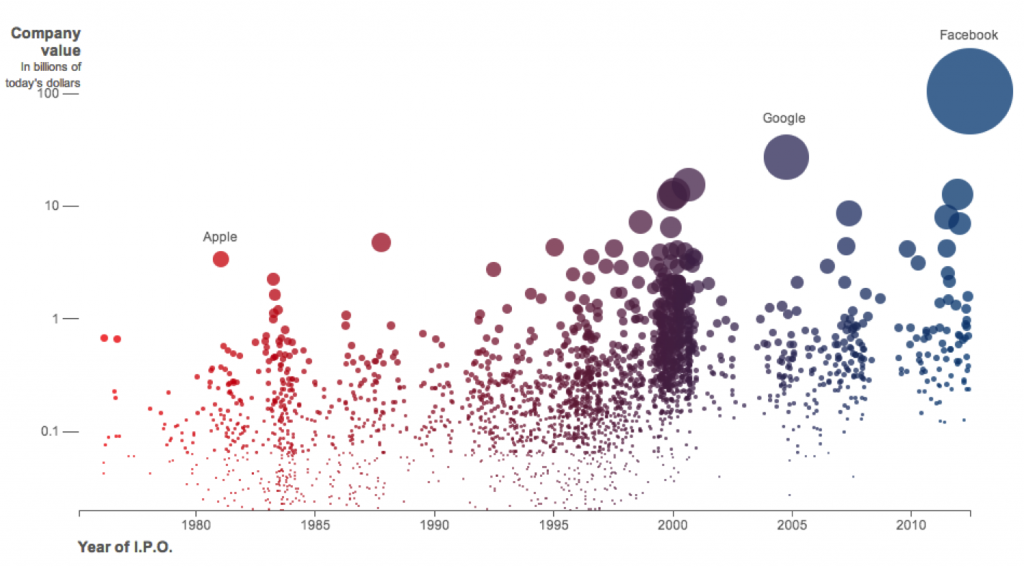

As this chart of tech IPOs over the past 30 years from the New York Times illustrates, the trend since the early 2000’s has been fewer and larger IPOs, requiring more revenue (with a few exceptions) to go public than in the past.

Some point to the increased cost of regulatory compliance as a result of Sarbanes-Oxley, enacted in 2002. Others point to economic volatility since the 9/11 attacks. Whatever the case, it is undeniable there have been fewer IPOs in recent history.

Having to take the company farther before founders and employees can take chips off the table changes the risk-reward equation. Valuation comparisons based on a variety of metrics lead to different conclusions – but for rapidly growing technology companies, revenue multiple is often the best proxy for comparing valuations. The range of multiples is all over the map, but with 2/3 of companies getting less than 4x multiples, who can blame an entrepreneur that builds a $10-$20 million company for exiting earlier with higher multiples to strategic buyers? As one person I spoke with put it “these are smart people – they can take that and do it again – or just go play golf”.

I often hear it’s our culture in Atlanta that entrepreneurs cash out (earlier) and “live the good life” rather than do it again. Given the multiple examples of Atlanta entrepreneurs that not only built pillar companies, but also continued to be active entrepreneurs and investors, I’m not convinced that is the case. I think it has as much to do with the fact that most of the exceptions to this trend in recent years have been consumer technology companies. Atlanta’s historical strength has been enterprise technology and the absence of these consumer tech exceptions that exist in other tech hubs may lead us to jump to the conclusion the trend is unique to Atlanta.

Both M&A activity and IPOs are increasing in pace again – so it’s unclear what this dynamic will mean going forward. Companies like AirWatch, Bridge2Solutions, MailChimp, and SoloHealth remain in high growth mode and continue to scale so perhaps this will change. In the current state, the private equity market will have to step in with investments that enable entrepreneurs to take some money off the table and fund the company for continued rapid growth if we are going to see more ‘pillar companies’.

What do you think? Is cashing out early our culture in Atlanta – or is it a result of market conditions?