Last month, Urvaksh Karkaria of the Atlanta Business Chronicle was kind enough to write an article (click here to read) on my new seed and early stage venture fund, Tech Square Ventures. The article speculated I might be “stepping onto a crowded field” and had quotes that supported the view that there was no shortage of funding for Atlanta’s entrepreneurs. Several people have asked what I thought about that. Obviously I don’t agree or I wouldn’t be launching a new seed and early stage fund!

In an earlier post, Does Georgia Have a Venture Funding Shortage, I pulled together statistics from the PWC Moneytree report to see how we stacked up against other leading tech hubs. With 2013 behind us, I took a look at the latest data to see what has changed.

Total investments in Georgia in 2013 were $412 million, up 57% from $263 million in 2012, and ranking Georgia 12th in investments by state last year (up from 14th).

Great news right? Not quite. 2013’s number includes $180 million from AirWatch alone. Without the AirWatch deal, 2013 would have been $232 million – down 11% from 2012, ranking Georgia 18th in investments by state. The number of deals was also down 25%.

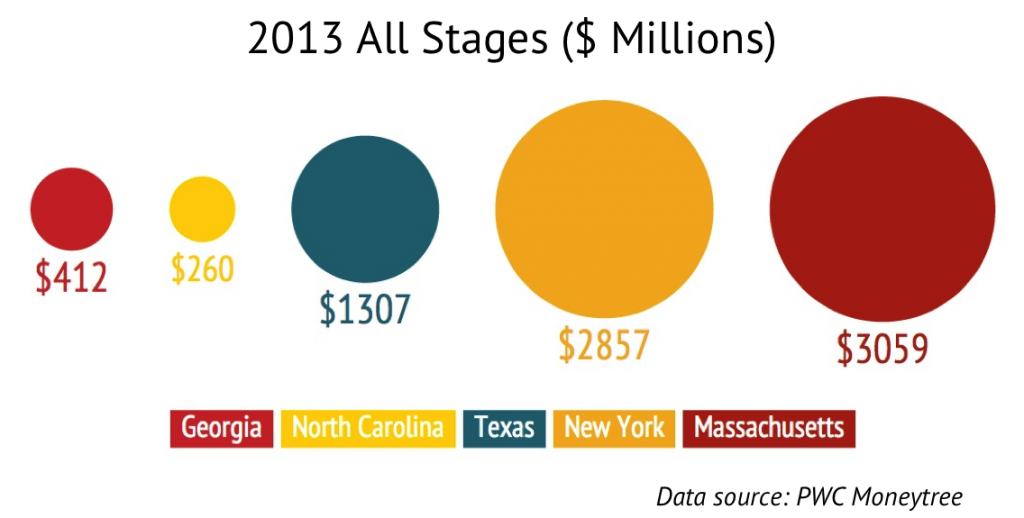

In the previous post I compared Georgia to leading tech hubs North Carolina, Texas, Massachusetts, and New York. I did the same with 2013 data and, like before, I left out Silicon Valley – we already know the answer to that.

Among those tech hubs, Georgia lags all but North Carolina in venture investments, and they have up to 7x the amount invested here in Georgia.

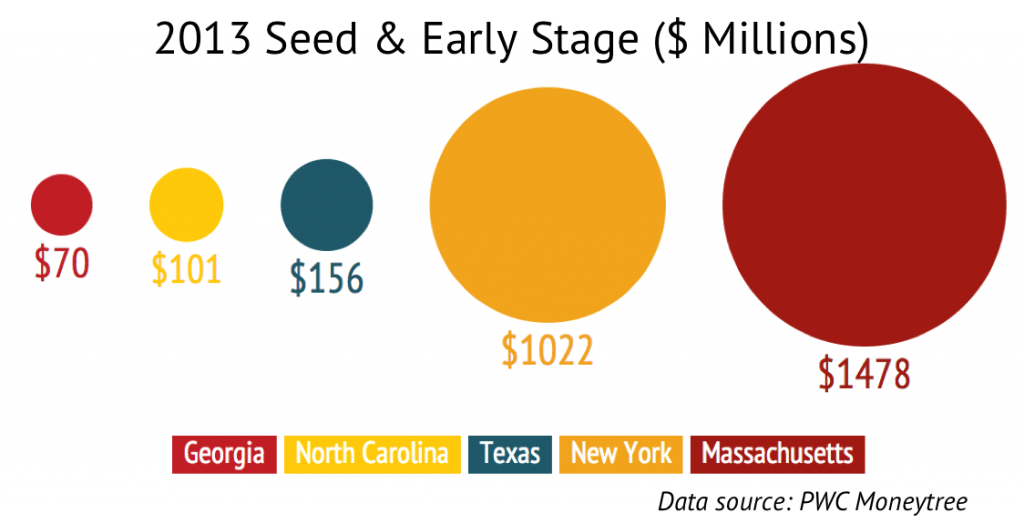

The root of the problem is more evident when you look at just seed and early stage investments. Georgia lags each of those regions and they have up to 21x the seed and early stage amounts invested here in Georgia.

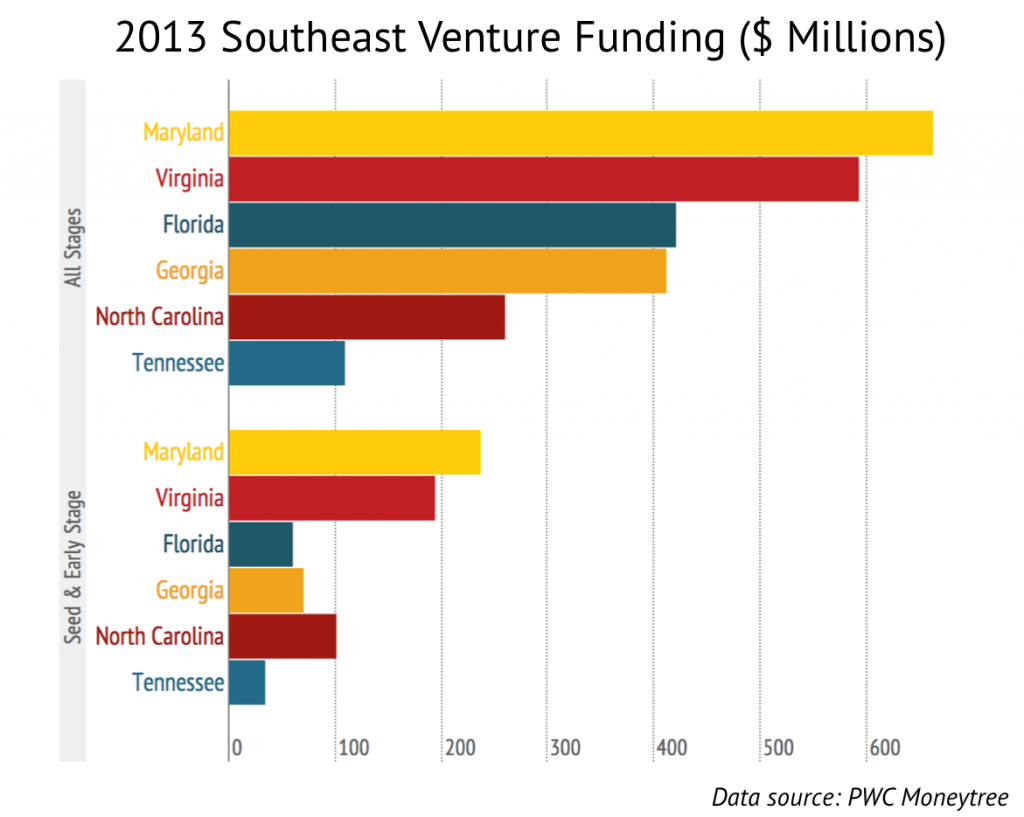

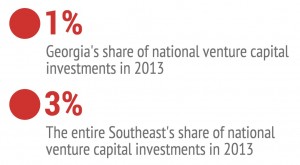

Perhaps more surprising is the fact that Georgia ranks only 4th in the Southeast – trailing Maryland, Virginia, and Florida. Without the AirWatch deal, Georgia would have been ranked 5th. Georgia also ranks 4th in seed & early stage investments behind Maryland, Virginia, and North Carolina. When looking towards the future, one statistic stands out: seed & early stage investments represent 17% of the total amount invested in Georgia, while in all 3 states ahead of us it represents more than 33%. Those states are investing in more robust pipelines going forward.

Much of the increase in startup activity we saw in 2013 in Atlanta was essentially ‘pre-seed’ activity. Out of all that activity will emerge a greater number of fundable companies.

Crowded field? In this case I think my friend Urvaksh is off base, and the data supports that. I started Tech Square Ventures because I believe the current level of investment does not reflect the opportunity here. In short, I’m betting on our entrepreneurs and area research universities to generate plenty of opportunities for investment.