In just the first few weeks since launching Tech Square Ventures, I’ve met one-on-one with 16 startups (some multiple times) and looked at materials from dozens of additional companies.

In just the first few weeks since launching Tech Square Ventures, I’ve met one-on-one with 16 startups (some multiple times) and looked at materials from dozens of additional companies.

What I have quickly learned is the hardest part of evaluating opportunities is getting up to speed on the specific addressable market the startup serves.

Breaking down the addressable market and the specific pain in the market that the startup solves is a challenge with early stage companies. I look to get a handle on the intensity of the pain the solution addresses and the size of the market that has that pain. I look to understand how those customers are solving that pain today (competition). I also look to understand the industry conditions to determine market readiness for change necessary to drive adoption of the startup’s innovative solution.

The other night I was talking about this with my wife, Stephanie. We recently moved so I compared it to shopping for a house.

Trying to determine the value and opportunity of a startup is like trying to determine the value of a house without knowing what neighborhood it’s in.

When you shop for a house, you don’t try to add up the cost of the lumber, drywall, and roofing materials to determine the value. You compare it to other houses in the neighborhood. Without understanding the market and industry conditions, it’s like knowing the details on the house, but not what where it is.

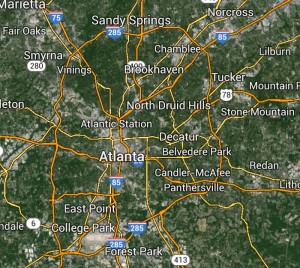

Startups that have gone through programs like Customer Discovery and Gauntlet at ATDC, Flashpoint, VentureLab / NSF-iCorps, or other similar programs have a significantly better grasp on their target customer, addressable market, and industry conditions – and they are better at communicating it. When pitching an investor – make sure you help them understand what neighborhood you are in.